On December 24, I received an email from US Bank informing me that a purchase had been made the previous day about two thousand miles away using my VISA debit card. I logged on to my online banking account and saw that two more fraudulent transactions were pending.

I immediately called US Bank’s fraud department and closed the card. They told me that the transactions were “card present” transactions, meaning someone had created a fake card with my card number.

Slow, Uninformative Alerts

The only reason I discovered this fraud was that I had an alert configured on my checking account to email me on debits over $50. However, I didn’t receive the alert about the first transaction until the following morning, and the alert didn’t tell me who had made the charge. I had to log on to online banking to confirm it was fraudulent; that’s when I saw that two additional transactions were pending.

If I had received an alert within a few minutes of the first transaction (as I do when I use my Capital One and Chase credit cards), I could have shut down the card immediately and avoided the additional transactions. US Bank has the data: you can see the pending transactions if you log on to online banking. So why not send out alerts immediately?

Over the next few days, I asked four or five representatives why US Bank does not send alerts promptly. I received various answers, e.g. alerts are batched and only sent three times a day, you can log in to online banking to see if there are pending transactions, a check card is different from a credit card because transactions are authorized before they are charged, they are looking into faster alerting systems, and they can’t tell me to rely on alerts because then they would be liable if an alert didn’t go out in a timely fashion.

Fast Alerts – The Big Secret

What no one told me is that US Bank does offer near-instant alerts if you know how to configure them.

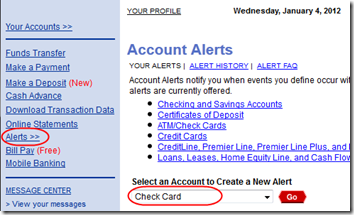

It’s simple, really: in addition to the (slow) checking account alerts, in online banking, add alerts to your Check Card:

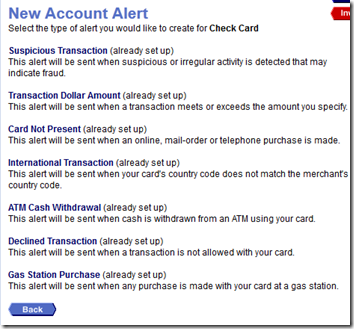

You’ll have several categories to choose from. I’ve now configured them all:

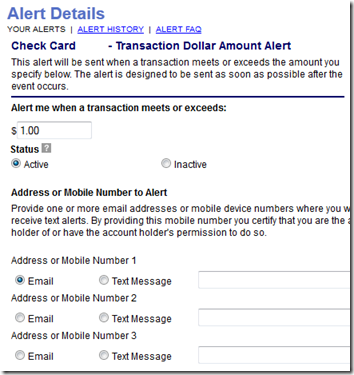

I set up my Transaction Dollar Amount alert to email me on any transaction over $1. Yes I get a few extra emails that way; big deal, I just delete them. At least I’ll know if someone besides me starts charging even small stuff on my card:

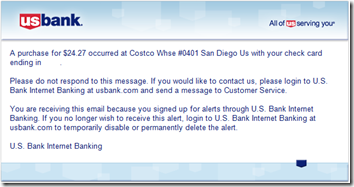

That’s it! Once configured, when you make a purchase (whether using the check card as a debit card with PIN or as a VISA card), within a few minutes, you should see an email like this listing both the vendor and the amount:

My hunch is that these Check Card alerts are tied directly to the VISA transaction clearing system, so just as with other credit cards, they are sent almost instantly.

Of course, it’s possible that the alerts may sometimes be slow or even fail, but at least this gives you a fighting chance to find out quickly if your Check Card is ever compromised.

Update January 26, 2011

In the last week or two, there have been a few cases where the Check Card alerts were not processed as promptly as they used to be. For example, a charge I made at 9pm didn’t email until 10:30am the next day. Still, it makes sense to define all possible alerts so you have the best chance of being notified when someone besides you is using your card.